On its own, the $745 billion Tesla (TSLA.O) ceding the global electric-vehicle sales crown to China’s BYD (002594.SZ) isn’t catastrophic. But straining profit and growing trade protectionism risk taking the sheen off boss Elon Musk’s once world-beating colossus. There are few easy ways to escape the pressure in the auto manufacturing industry. But Tesla can do something better: become an indispensable part of U.S. infrastructure.

Despite falling behind BYD, Tesla is still increasing sales, even taking share in China. Even with that, the foundation of Musk’s empire looks fragile. Tesla has a privileged position in China, where its factory can now produce a million cars annually, compared to 1.8 million total made last year. That factory is crucial to profitability. When it opened, Tesla’s automotive gross margin stood at 20%; that rose to 30% by 2022, as its global cost per car sold fell by over $7,000. Shanghai is Tesla’s base to export cars around the world.

While relationships with Xi Jinping’s government have been warm, there is a risk it could wane, or that a domestic industry that learned from Tesla could outpace it. If China decided to make Tesla’s life difficult, it could. Musk could counteract that by trying to grow elsewhere. But the relationship with Beijing has drawn European ire in particular, just as price competition has eroded the company’s profitability edge.

Imagine a worst-case scenario, where Europe ramps up defenses for homegrown automakers despite Tesla’s new local operations, and China becomes more hostile. There is no easy out: even the drastic move of merging with the likes of BYD would be a dead letter among wary national security regulators. Other promises from Musk, like the advent of revolutionary AI or robots, keep moving further off.

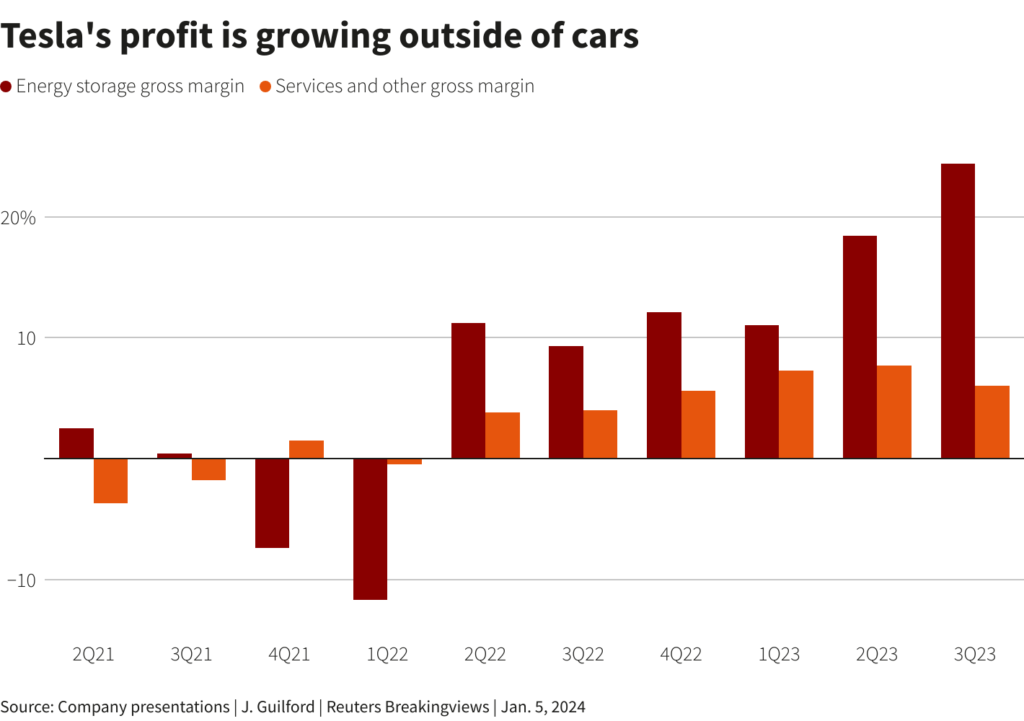

There is another path. Tesla is right that it’s not just a car company – but not because of bipedal robots. Despite shrinking profit elsewhere, gross margin at its energy storage business has exploded. Tesla leads the U.S. storage market with a 25% share, according to Wood Mackenzie, as state power utilities look to its giant battery packs to offset renewables’ intermittency.

Elon Musk’s Tesla faces competition from Chinese carmaker BYD and growing backlash in Europe. Attempts to diversify through AI and robots are seen as far-fetched. However, the company has potential in becoming a cornerstone of US infrastructure. Tesla’s profitability has been affected by rising price competition, but its energy storage and services segments have shown steady growth.

Elon Musk says cage fight with Mark Zuckerberg will be streamed on X

[…] by /u/nataliia_walker [link] […]